Energy News 29 october 2024

Hawk Energy is pleased to present you with its latest Energy News 29 October 2024 Energy News issue - 1757

Iraq: QatarEnergy Join TotalEnergies in 1.25 GW solar project

QatarEnergy, one of the world's top suppliers of liquefied natural gas, said on Monday it had agreed to take a 50% stake in TotalEnergies' 1.25-gigawatt solar project in Iraq.

The French energy giant will retain the remaining 50% stake in the project, which is part of Iraq's $27 billion Gas Growth Integrated Project (GGIP), QatarEnergy said in a statement, without disclosing the size of the deal.

The GGIP initiative aims to improve Iraq's electricity supply, including by recovering flared gas at three oilfields and using the gas to supply power plants, helping to reduce Iraq's import bill. It also includes renewable energy projects.

Iraq currently imports between a third and 40% of its supply of electricity and gas from Iran, but continues to suffer from widespread power cuts, especially in the hot summer months when demand for power for cooling surges.

The solar project, which will be developed in phases to come online between 2025 and 2027, will generate up to 1.25 GW at peak using 2 million bifacial solar panels, QatarEnergy said. It will be able provide electricity to about 350,000 homes in the oil-rich Basra region in southern Iraq, the company added.

QatarEnergy last year joined a consortium to implement the GGIP project with a 25% stake, while TotalEnergies and Iraq's Basra Oil Company held the remaining 45% and 30% stakes, respectively.

Singapore: Wood to deliver FEED for Singapore LNG expansion

Wood, a global leader in consulting and engineering, has been awarded the front-end engineering design (FEED) contract for the development of Singapore’s Second liquefied natural gas (LNG) Terminal by Singapore LNG Corporation (SLNG).

Wood to deliver front-end engineering design for Singapore LNG expansion

According to the Singapore Economic Development Board, more than 95% of electricity in Singapore is generated from natural gas. With an estimated five million tons per annum of additional capacity to come from this expansion, the new terminal will further enhance and secure Singapore’s growing energy needs.

This project will feature a floating storage and regasification unit (FSRU), a specialised vessel used for LNG and the first-of-its-kind deployed permanently for Singapore. Intended to be located at the Jurong Port, the terminal will feature facilities for transfer of regasified LNG from the ship to the onshore gas transmission network. Wood will review the FSRU design and coordinate its integration into the onshore connecting infrastructure.

Henry Ling, Senior Vice President of Process & Chemicals Asia Pacific for Wood, said: 'We are thrilled to be awarded the engineering contract for the Second LNG Terminal, enabling the delivery of additional low-carbon LNG services.

'Wood successfully supported SLNG with the engineering of the first LNG Terminal which was completed in 2013. We will deliver the same exceptional quality of work for this complex concept, utilising our expertise in LNG terminal design and regasification. Combining our marine infrastructure design and experience with Singapore’s regulatory approvals will bring this lowcarbon concept to reality.'

Over 50 Wood employees based in Singapore will be involved in delivering the project, with subject matter experts in Ireland and Scotland supporting on the marine infrastructure design and experts in Spain supporting on the FSRU design.

CONSTRUCTING A STATE-OF-THE-ART-SUPERSTRUCTURE

The Singapore LNG Terminal is unique in many aspects of its design, for which it has won a number of awards such as:

- The ASEAN Outstanding Engineering Achievement Award 2014

- The IES Prestigious Engineering Achievement Award for 2014

- Process Safety Award 2013 by IChemE, Singapore

Libya: After a halt since 2014 - Eni and BP resume operations

Eni and BP have resumed their exploration activities in Libya after halting drilling operations in the onshore region since 2014. Meanwhile, Repsol is preparing to restart drilling in the Murzuq Basin, and OMV is set to begin operations in the Sirte Basin in the coming weeks.

On Saturday, October 26, Eni began its exploration activities in the Area B (96/3) of Ghadames Basin, where the first exploratory well, A1-96/3 (Hasheem Prospect), was drilled

It’s worth noting that the A1-96/3 well is the first under the contractual obligations for the Area B in Ghadames Basin, according to the Fourth Bid Round Contract of 2007. Eni operates the area in partnership with BP and the Libyan Investment Authority.

Mellitah Oil & Gas, with its extensive experience in the region, particularly in developing and managing the Wafa field, is overseeing the drilling operations and all related activities for this well.

Several promising geological formations in the A1-96/3 well are set to be tested, with expectations that they will contain both oil and gas. The well is projected to reach a final depth of approximately 10,327 feet (3,147 meters).

The A1-96/3 well is located about 35 kms from the Wafa field and approx. 650 kms from the capital, Tripoli. The EPSA includes three contract areas, two in the onshore Ghadames basin and one in the offshore Sirt basin, covering a total area of around 54,000 km2. Originally awarded in 2007, work on the EPSA has been suspended since 2014.

As part of the LOI, the signatories also reconfirmed their commitment to promote technical training and other social initiatives in Libya.

As set out in the LOI, the companies intend to finalise and complete all agreements by the end of this year, with a target of resuming exploration activities in 2019.

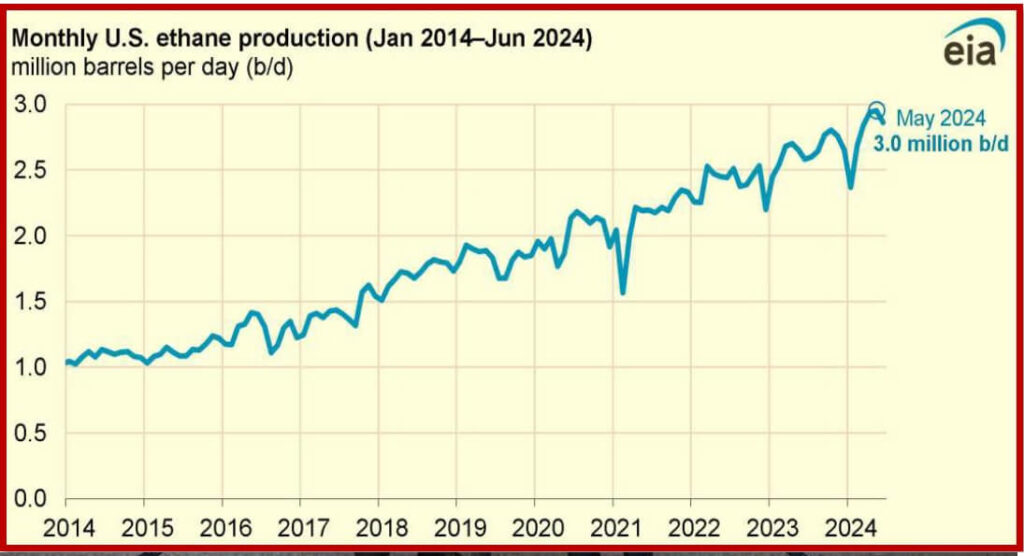

U.S. ethane production reached a record 3.0 MB/D in May 2024

U.S. ethane production increased steadily over the last decade and reached a record of 3.0 million barrels per day (b/d) in May 2024. Ethane production in the first half of 2024 (1H24) averaged a record 2.8 million b/d, according to data from our Petroleum Supply Monthly. The increase was driven by more natural gas and ethane production in the Permian Basin, which spans Texas and New Mexico.

Ethane serves mainly as a petrochemical feedstock to produce ethylene, which is used to make plastics and resins. Continued growth in ethane consumption in the global petrochemical sector, increasing proportions of ethane derived from U.S. natural gas production, and favorable production economics have driven steady increases in ethane production in recent years.

Extraction Of Ethane

In the United States, almost all ethane is recovered at natural gas processing plants, which remove ethane and other natural gas plant liquids (NGPL) from raw natural gas. During 1H24, U.S. marketed natural gas production, which includes dry natural gas and NGPLs before they are separated out, averaged a record 112.8 billion cubic feet per day (Bcf/d), 1.0 Bcf/d more than the 1H23 average.

Ethane production in the Texas Inland and New Mexico refining districts, which include the Permian Basin, accounted for 62% of U.S. ethane production during 1H24, slightly more than the 60% share in 1H23.

Ethane production in these two districts averaged 1.7 million b/d in 1H24, a 7% (0.1 million b/d) increase from 1H23. Ethane production in the Appalachian No. 1 refining district, which straddles most of the Appalachian Basin production area in Pennsylvania and West Virginia, also increased during 1H24, averaging 327,000 b/d, up from 292,000 b/d in 1H23. Ethane production in other refining districts remained essentially unchanged from 1H23.

U.S. Ethane Production and consumption

U.S. ethane production continued increasing to meet growing demand from domestic and international consumers.

Consumption of ethane in the United States in 1H24 averaged 2.3 million b/d, up from 2.1 million b/d in 1H23, while U.S. ethane exports averaged 470,000 b/d, down 17,000 b/d compared with 1H23.

The United States began exporting ethane in 2014 to petrochemical plants in Canada and became the world’s largest exporter of ethane in 2015, when tanker exports to Europe began. The most common destinations for ethane exports in 1H24 were China (45% of U.S. ethane exports; 212,000 b/d), Canada (15%; 70,000 b/d), and India (14%; 65,000 b/d).

In our Short-Term Energy Outlook, we expect ethane production to average 2.8 million b/d in both 2024 and 2025, a 5% increase compared with 2023. We expect domestic ethane consumption to average 2.3 million b/d in both 2024 and 2025, a 5% increase compared with 2023. We expect U.S. net ethane exports to rise to 490,000 b/d in 2024 and 520,000 b/d in 2025, an 11% increase from 2023 to 2025.

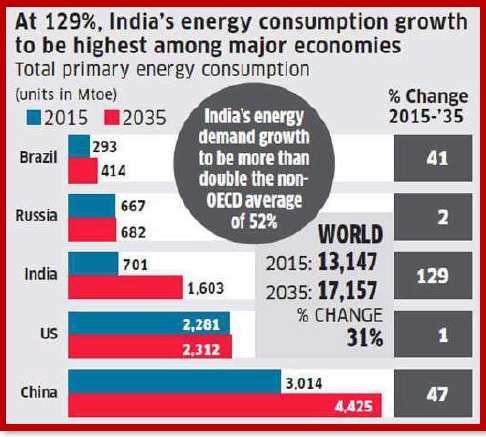

Asian energy demand rises amid global tech and mining evolution

The global markets continue to showcase the complex interplay between traditional and emerging sectors, as evidenced by developments across energy, technology, and regulatory landscapes this week.

Oil markets exhibited notable resilience amid persistent geopolitical tensions, with prices heading for a weekly rise despite ongoing concerns about demand. While traders remain cautious about potential escalations in the Middle East, attention has also turned to Asia's growing energy appetite.

India's Oil Demand

India's oil demand is projected to increase by 4% in Q4 , driven by post-monsoon industrial activity and festival season consumption. This growth, coupled with China's 6% increase in crude import quotas for private refiners, signals robust energy demand from Asia's largest economies.

The surge in Asian demand comes at a particularly crucial time for global energy markets. India's consumption patterns are especially noteworthy, with diesel fuel showing only a minor decline of less than 2% during the monsoon season, while gasoline demand expanded by 3% during the same period.

This resilience in fuel consumption underscores India's position as one of the world's largest oil importers, with imported oil covering approximately 85% of the nation's requirements. The country's ambitious plans to expand its refining capacity by 20% to 6.19 million barrels daily by 2028 further emphasizes the long-term nature of this demand growth.

The technology sector provided a counterpoint to traditional energy markets, with Tesla's remarkable Q3 performance highlighting the accelerating transition toward sustainable transportation. The electric vehicle manufacturer reported earnings that exceeded analyst expectations, with shares surging over 30% in response.

Tesla's achievement of record-low production costs per vehicle, at approximately $35,100, demonstrates the increasing viability of electric vehicles as mainstream transportation options. The company's ambitious outlook, including projected delivery growth of 25-30% next year and plans for a self-driving taxi service launch in California and Texas by 2025, signals confidence in the continued evolution of sustainable transportation solutions.

Oil prices climb as US reserve bid lends support

Oil prices rose on Tuesday after tumbling 6% in the previous session, as a U.S. plan to buy oil for the Strategic Petroleum Reserve (SPR) provided some support though wider concerns about weaker future demand growth exerted pressure.

Brent crude futures climbed 74 cents, or 1.04% to $72.16 a barrel by 1026 GMT, while U.S. West Texas Intermediate crude was 68 cents, or 1%, higher at $68.06 a barrel.

A pump jack is seen at sunrise near Bakersfield, California October 14, 2014. REUTERS/Lucy Nicholson/File Photo Purchase Licensing Rights, opens new tab

On Monday, both contracts fell to their lowest since Oct. 1 after Israel's retaliatory strike on Iran at the weekend bypassed Tehran's oil infrastructure.

With signs that neither country seemed likely to escalate the conflict after the attack, investor concerns about flagging global oil demand growth for this year and next rose to the fore.

Declining oil demand from China, the world's largest crude oil importer, has been a drag on global oil consumption and prices.

Global refining margins are dismal as global oil demand growth remains below average due to sluggish economic activity in China, BP (BP.L), opens new tab CEO Murray Auchincloss told Reuters.

Demand will return to normal growth rates after Chinese President Xi Jinping introduces new stimulus measures to the economy, Auchincloss added.

"Following Israel's retaliation, event risk has faded, leaving the oil market to face up to macroeconomic realities. China, where industrial profits are slumping, will be front and centre," said Harry Tchilinguirian, group head of research at Onyx Capital Group.

Tensions in the Middle East remain high.

Iranian Foreign Ministry spokesperson Esmaeil Baghaei said on Monday that Iran will "use all available tools" to respond to Israel's weekend attack.The U.S. on Monday said it was seeking up to 3 million barrels of oil for the SPR for delivery through May next year, a purchase that would leave the government with little money to buy more until lawmakers approve more funds.

The U.S. announcement introduces a fundamental buyer into a category which at present has been sparsely populated, PVM's Evans said.

However, Tchilinguirian said the barrels are not enough to offset the broader pessimism around oil demand centred in China and Europe.

Crude oil and gasoline stockpiles in the U.S. likely rose last week, while distillate inventories were seen down, a preliminary Reuters poll showed on Monday.

The American Petroleum Institute industry group is scheduled to release a weekly report on Tuesday and the Energy Information Administration, the statistical arm of the U.S. Department of Energy, will issue one on Wednesday.